Teaching Financial Responsibility to Kids

Teaching Financial Responsibility to Kids

Instilling financial responsibility in children is a critical aspect of parenting that lays the foundation for a lifetime of financial literacy and independence. This comprehensive guide offers insights into key strategies and practical tips for teaching children about money management, saving, earning, and spending wisely.

Understanding the Importance of Financial Education

Financial literacy is an essential life skill that, when taught from a young age, can significantly influence a child’s ability to make sound financial decisions in adulthood. Understanding the value of financial education can drive parents and guardians to incorporate money lessons into everyday conversations and activities.

Starting Early: Introducing Money Concepts

Introducing basic money concepts can start as early as preschool, with simple discussions about coins, bills, and their value. This sets a foundation for more complex financial knowledge as children grow older and begin to understand the economy’s role in their environment.

Allowances and Money Management

Providing allowances is more than just giving children money; it’s an opportunity to teach budgeting, saving, and the consequences of spending decisions. Structuring an allowance system that aligns with real-world economics can significantly benefit a child’s understanding of money.

Making Saving a Habit

Saving should become a natural part of children’s financial routine. Encouraging kids to set aside a portion of their money for long-term goals teaches patience, goal-setting, and the rewards of delayed gratification.

Smart Spending: Quality Over Quantity

Teach children to make informed purchasing decisions by emphasizing the importance of quality over quantity. Guiding them to understand the long-term benefits of investing in well-made products can prevent wasteful spending.

Understanding Earning

Helping children comprehend the concept of earning money through chores or small jobs teaches the relationship between work and reward, and the value of money earned through effort rather than given as a gift or entitlement.

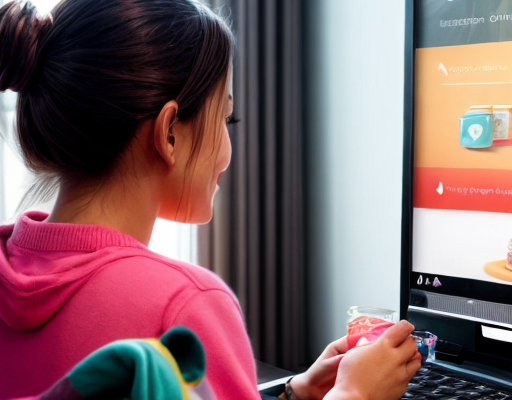

Interactive Financial Games and Apps

There is a variety of interactive games and mobile applications designed to make learning about money management fun and engaging for children. Leveraging technology can be a powerful way to reinforce financial concepts.

Budgeting Basics

Budgeting is a fundamental skill that can be taught through hands-on experience. Creating a simple budget with children for an event or purchase can provide practical lessons in resource allocation and the balance between income and expenses.

Credit and Debt: A Double-Edged Sword

Understanding credit and debt is pivotal in today’s world. Explaining the advantages and potential pitfalls of both concepts prepares kids for responsible credit management and the avoidance of unnecessary debt.

Investing and Compound Interest

Introducing the concept of investing and compound interest can show children how their money can work for them. Exploring basic investments and discussing interest can spark an interest in personal finance and future financial planning.

The Role of Banks and Financial Institutions

Teaching kids about the role of banks and other financial institutions helps them understand where to keep their money safe and the services these institutions provide, including savings, loans, and investment vehicles.

Philanthropy and Charitable Giving

Incorporating the values of giving and charity into financial education can teach children about empathy, compassion, and the impact of their financial choices on the broader community.

Price Comparison and Smart Shopping

Involve kids in shopping decisions by teaching them how to compare prices and seek out the best deals. This practice not only saves money but also develops analytical skills when it comes to making purchases.

Necessities vs. Luxuries

Distinguishing between needs and wants is a critical decision-making skill. Guiding children to understand the difference ensures they prioritize their spending and make sensible choices.

Economic Principles and Market Forces

Older children can grasp more complex economic principles. Introducing topics like supply and demand, inflation, and market cycles can add depth to their financial knowledge and help them comprehend the larger economic picture.

Real-life Financial Examples

Nothing teaches better than real-life examples. Sharing your financial experiences, both successes and challenges, can offer valuable life lessons and foster open communication about money matters within the family.

The Impact of Technology on Finance

The ever-evolving landscape of technology in the financial sector, such as online banking, cryptocurrency, and mobile payment platforms, warrants discussion about the importance of staying informed and how to safely navigate these tools.

Financial Independence and Responsibility

The ultimate goal of teaching financial literacy is to enable kids to become financially independent and responsible adults. Providing a roadmap that includes both successes and setbacks can empower children to take charge of their financial future confidently.

Monitoring Progress and Adapting Lessons

As children grow older, their financial understanding deepens and their needs change. Parents should monitor progress and adapt lessons accordingly, ensuring education remains relevant and effective.

Conclusion: Building a Financially Sound Future

In conclusion, teaching financial responsibility is a multi-faceted process that evolves with a child’s age and developmental stages. By introducing money concepts early, practicing sound financial behaviors, and continuously adapting lessons, parents can provide their children with the tools necessary for a financially responsible and independent future.